Looking to enhance your financial modeling skills? Look no further!

In this blog post, we will explore the top financial modeling courses available for individuals of all backgrounds and expertise levels.

Whether you’re a finance professional looking to upskill or a student wanting to kickstart your career, these courses are perfect for you. Get ready to dive into the world of financial modeling and take your skills to the next level.

Featured Courses:

- Financial Modeling Course

- Financial Modeling Specialization

- Financial Modeling Professional Certificate

What Are the Best Financial Modeling Courses?

Financial Modeling Courses

#1. Financial Modeling Course

Provider: Corporate Finance Institute (CFI)

A comprehensive library of financial modeling courses spans everything from beginner foundations to highly advanced techniques. You’ll gain hands-on experience building essential models, including three-statement forecasts, M&A models, and leveraged buyouts (LBOs). Specialized courses also delve into industry-specific modeling for sectors such as mining, real estate, startups, renewable energy, and ESG initiatives. Whether you’re an aspiring analyst or an experienced finance professional, these programs will strengthen your modeling expertise while earning continuing professional education (CPE) credits.

#2. Financial Modelling and Analysis

Provider: University of Cape Town (UCT)

The course will teach you how to create a mathematical model in Microsoft Excel that reflects the historical, current, or projected value or financial performance of an asset, stock, or investment. With guidance from expert faculty, you’ll learn how to make strategic business decisions with financial modeling and create a discounted cash flow analysis using financial forecasts. After completing the course, you’ll have the skills to build revenue models and determine realistic forecast assumptions.

#3. Business & Financial Modeling Specialization

Provider: Wharton (Coursera)

This Financial Modeling Specialization is designed to help you make informed business and financial decisions. These foundational courses will introduce you to spreadsheet models, modeling techniques, and common applications for investment analysis, company valuation, forecasting, and more. When you complete the Specialization, you’ll be ready to use your own data to describe realities, build scenarios, and predict performance.

#4. Breaking Into Wall Street (BIWS)

Provider: BIWS

In this course, you’ll learn accounting, valuation, and financial modeling from the ground up with 10+ real-life case studies from around the world, including: Monster Beverage, Stadler Rail (Switzerland), Coles (Australia), Vivendi (France), Steel Dynamics, NichiiGakkan (Japan), the Great Canadian Gaming Corporation, and Netflix. These case studies are geared toward interview prep, modeling tests, and case-study evaluations in interviews. You’ll learn the concepts so that you can answer questions easily by referencing your thought process.

#5. Financial Edge – The Modeler

Provider: Financial Edge

This financial modeling course covers key settings, formatting standards, building models on one sheet and across sheets, balancing the balance sheet using the cash flow statement, and preparing the model for handover. By the end, you’ll be able to forecast three statement models given a simple set of assumptions and using keyboard shortcuts.

#6. Beginner to Pro in Excel: Financial Modeling and Valuation

Provider: Udemy

This course is suitable for graduates aspiring to become investment bankers as it includes a well-structured DCF model with its theoretical concepts. Moreover, it motivates you to be more confident with daily tasks and gives you the edge over other candidates vying for a full-time position.

#7. Financial Modeling in Excel

Provider: Datacamp

Take your modeling skills to the next level by diving into scenario analysis. You’ll learn how to forecast multiple outcomes, conduct sensitivity analysis, and effortlessly manipulate growth rates using Excel’s versatile tools. In this comprehensive course, you will be empowered with the knowledge and tools to excel in financial analysis. You’ll construct a financial model, calculate net income, and gain a solid understanding of what makes up an income statement. These skills will form the foundation of your financial modeling prowess.

Financial Modeling Certifications

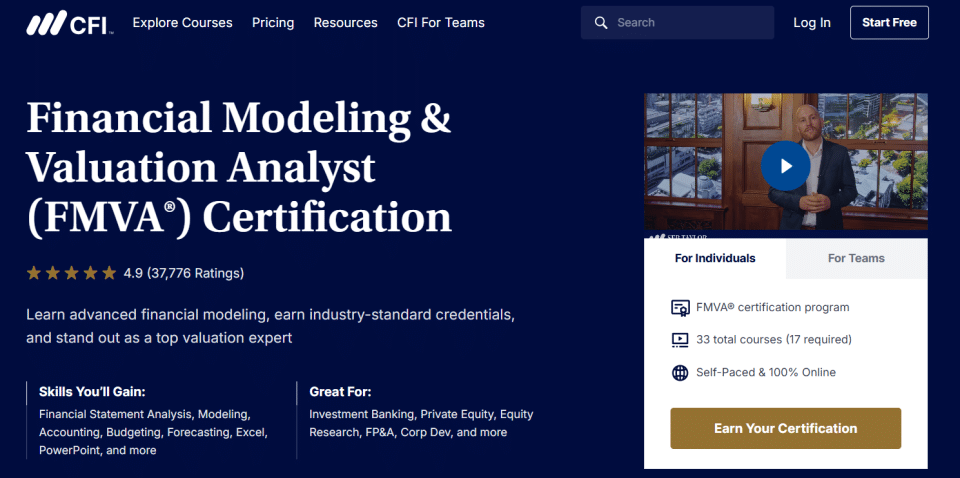

#7. FMVA® Certification

Provider: CFI

The FMVA® certification equips you with essential skills and tools for success as a financial professional. The hands-on curriculum and real-world applications prepare individuals for roles in investment banking, private equity, M&A, business valuation, and corporate finance. Designed for busy professionals, facilitates self-paced learning for skill enhancement and career advancement. This comprehensive program ensures mastery in modeling, budgeting, forecasting, and overall competency in accounting and finance.

#8. Financial & Valuation Modeling Certification Program

Provider: Wall Street Prep

In this program, you will get the same program that top investment banks and financial institutions use to train their professionals. Learn 3-Statement Modeling, DCF, Trading and Transaction Comps, M&A, and LBO. Premium Package learners are eligible to earn Wall Street Prep’s globally recognized Financial & Valuation Modeling Certification. The certification is earned by completing the final exam for each of the program’s 6 courses. These online assessments can be taken any time after enrollment in the program.

#9. Financial Modeling Professional Certificate

Provider: New York Institute of Finance (NYIF)

In this financial modeling course, you learn how to build common to complex financial models on Excel with information provided both on financial statements and from external sources. This program is for entry-level finance professionals, investment professionals, financial analysts, corporate bankers, and lateral hires. Learn Hands-on training to build real-world models with examples from today’s top firms.

Financial Modeling Courses FAQs

1. What is a financial modeling course?

A financial modeling course teaches you how to build structured Excel models that represent a company’s financial performance. These models are used for valuation, forecasting, M&A, private equity, and decision-making.

2. Who should take a financial modeling course?

Finance students, investment banking/consulting candidates, corporate finance professionals, and entrepreneurs benefit most. Anyone who wants to analyze businesses, investments, or projects can gain from it.

3. Do I need a finance or accounting background?

Not always. Beginner-friendly courses (like Udemy or Wharton’s Coursera specialization) start with the basics. However, understanding accounting principles and Excel helps you learn faster.

4. What skills will I learn in a financial modeling course?

- Building 3-statement models (income statement, balance sheet, cash flow)

- Valuation techniques (DCF, comparables, precedent transactions)

- Scenario & sensitivity analysis

- LBO and M&A modeling (advanced courses)

- Excel shortcuts and efficiency tricks

5. How long does it take to complete a financial modeling course?

It depends on the program:

- Short courses: 10–20 hours (1–2 weeks)

- Professional certifications (like FMVA): 80–120+ hours (2–3 months at part-time pace)

- Advanced specializations: up to 6 months

6. Are financial modeling certifications worth it?

Yes. Recognized certifications like FMVA (CFI), WSP, and NYIF show employers you have structured training and practical modeling skills, making you more competitive in finance roles.

7. What software is used in financial modeling courses?

Most courses use Microsoft Excel, since it’s the industry standard. Some also introduce Google Sheets, Python (Pandas/NumPy), and Power BI for advanced modeling.

8. How much do financial modeling courses cost?

- Entry-level courses: $20–$200 (Udemy, DataCamp)

- Premium programs: $400–$1,500 (Wall Street Prep, BIWS, Financial Edge)

- Full certifications: $500–$1,200 (CFI FMVA, NYIF, university certificates)

9. Can I get a job after taking a financial modeling course?

A course alone won’t guarantee a job, but it strengthens your resume and gives you practical skills employers expect in investment banking, corporate finance, equity research, and consulting.

10. Which is the best financial modeling course in 2025?

It depends on your goal:

- Best for beginners: Wharton on Coursera, Udemy Modeling

- Best professional certification: CFI FMVA

- Best for investment banking prep: Wall Street Prep or BIWS

- Best specialization: Financial Edge (The Modeler)

Final Thoughts:

Whether you’re completely new to Financial Modeling or a seasoned finance professional, these online financial modeling courses mentioned in this article offer comprehensive training that will expand your knowledge of financial modeling to the highest level.